2 min

2 min

-

How do I find out whether a loan fits my budget?

-

Why is budget planning vital?

-

To what extent can advice on this topic provide me with information?

If you are planning a new purchase or would like to pursue further education but don't have enough money put aside at the moment, a loan may be the right solution.

However, any borrowing must always be appropriate in consideration of the client's financial circumstances. That is why BANK-now and other financing institutions have formulated important principles for responsible borrowing, also complying with the legal provisions of the Swiss Consumer Credit Act (CCA). By doing so, the members of the Association of Swiss Credit Banks and Financial Institutions (VSKF) and the Swiss Leasing Association (SLV) who are active in the personal loan and consumer leasing business want to make an active contribution to preventing over-indebtedness.

To find out whether you can really afford your new life plan or planned purchase, it is important to first do a budget calculation. "Budget planning helps to give an overview of income and outgoings," explains Irene Fernandez, Head of Customer Care at BANK-now. "It indicates whether a loan is even an option."

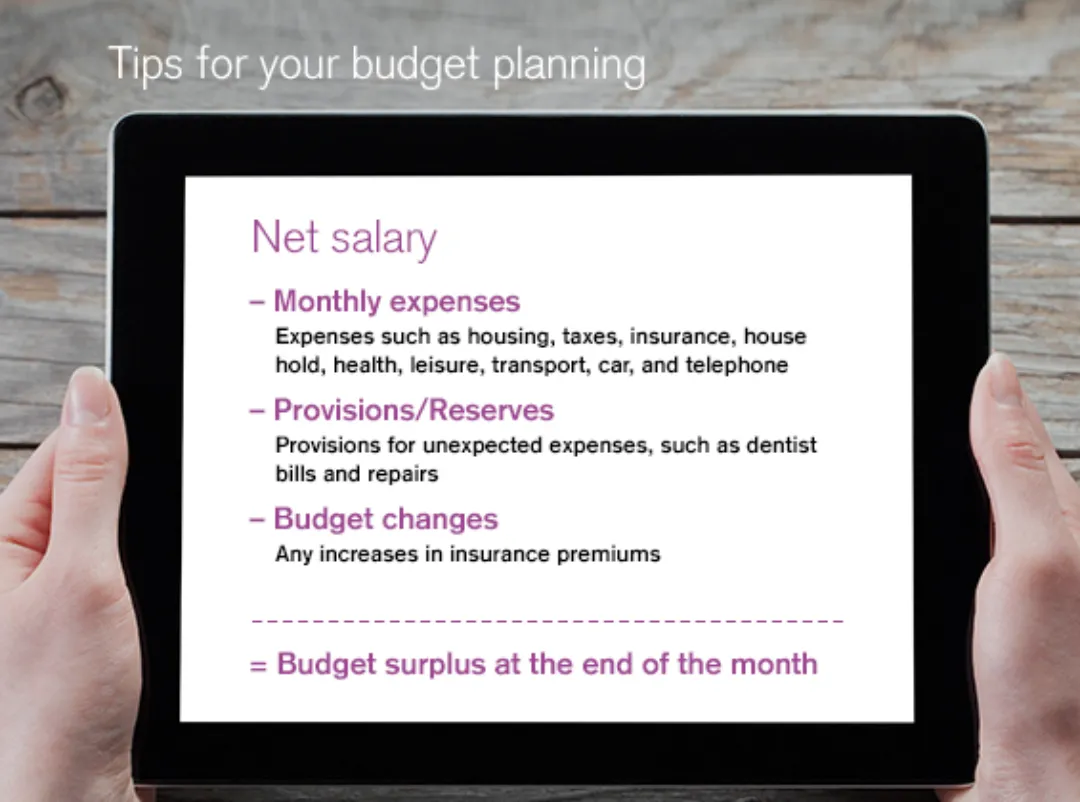

As part of the statutory creditworthiness check, the interested party and an expert create an overview of the individual's financial situation together. The expenses incurred for general living costs, housing, taxes, compulsory health insurance, household costs, health, and transport are compiled and compared against the monthly net income and a monthly budget surplus is calculated. This check shows whether or not the desired loan fits your budget and can be granted.

A budget plan provides security

"The security we give our clients by drawing up a budget plan together is great," says Irene Fernandez. This step is an important part of the lending process.

Incidentally, budget planning is recommended regardless of whether you are taking out a loan. It is important, for example, to help you ascertain where exactly your money is going. Is there anything I can optimize? Or is there something I spend too much on? Going out or clothes, for example? These are questions that everyone should ask themselves every now and again, Fernandez says.

Tips for budget planning

In order to keep your budget under control at all times, it is advisable to automate personal payment transactions by direct debit or standing order, to make provisions in good time for unexpected expenses such as dental visits, etc., and to carefully check receipts such as credit card statements.